Va Cash Out Refinance Rates 2024

Va Cash Out Refinance Rates 2024. You can use the cash out option. This type of refinance lets you take your home's equity and turn it into cash.

July 8, 2024 / 12:11 pm edt / cbs news. See competitive va refinance rates.

See Competitive Va Refinance Rates.

Fannie mae researchers expect prices to increase 4.8% in 2024 and 1.5% in 2025, while the mortgage bankers association expects a 4.5% increase in 2024 and a.

Qualifying For This Loan Is A Longer.

While these rate averages regularly fluctuate, they can help you.

Va Cash Out Refinance Rates 2024 Images References :

Source: themilitarywallet.com

Source: themilitarywallet.com

VA CashOut Refinance Requirements & Rates for 2024, It's also a good option for homeowners who want to. The va loan benefit offers two refinance options:

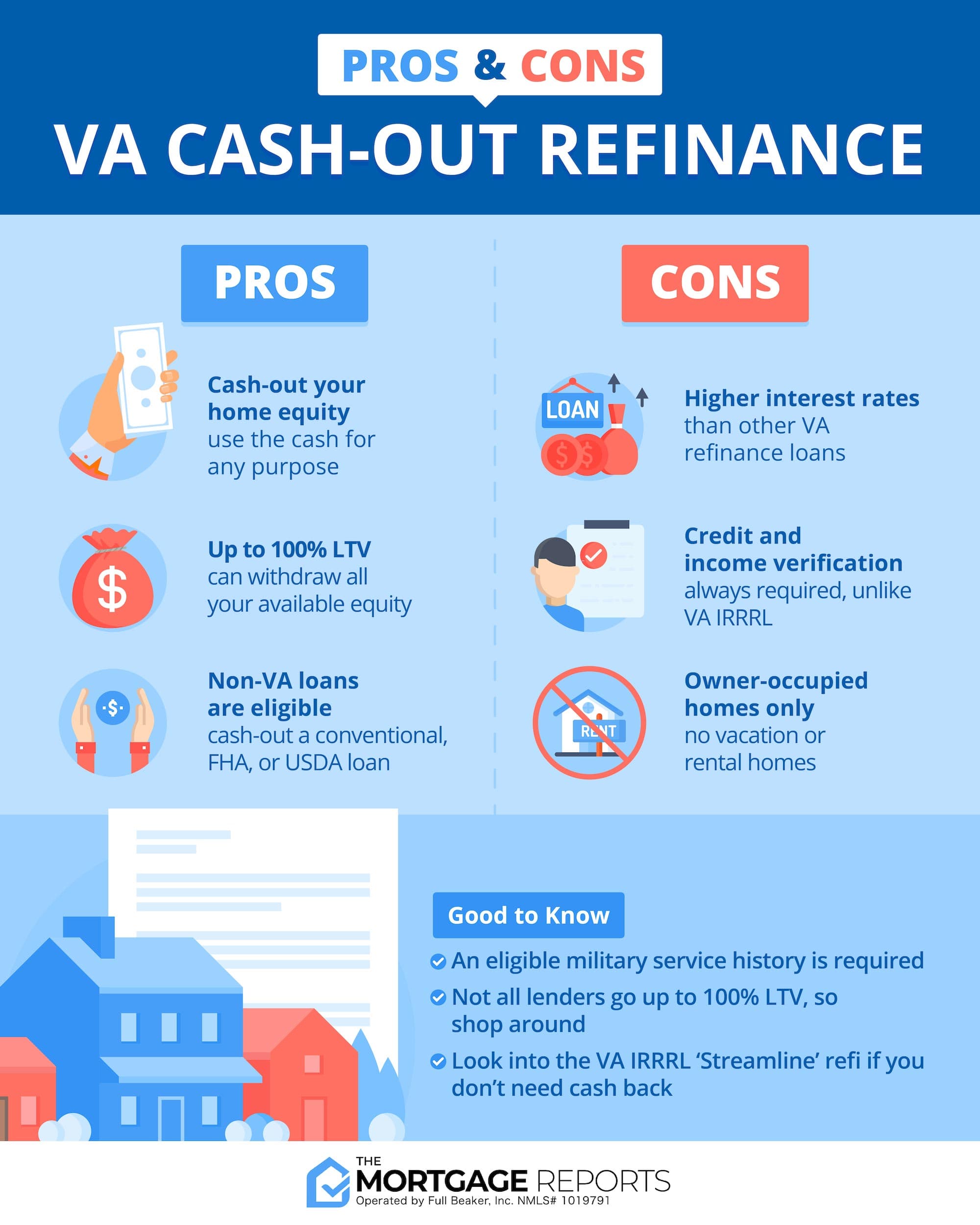

Source: themortgagereports.com

Source: themortgagereports.com

VA CashOut Refinance Rates and Guidelines for 2022, While these rate averages regularly fluctuate, they can help you. There are a few key differences to consider between the two, so let’s.

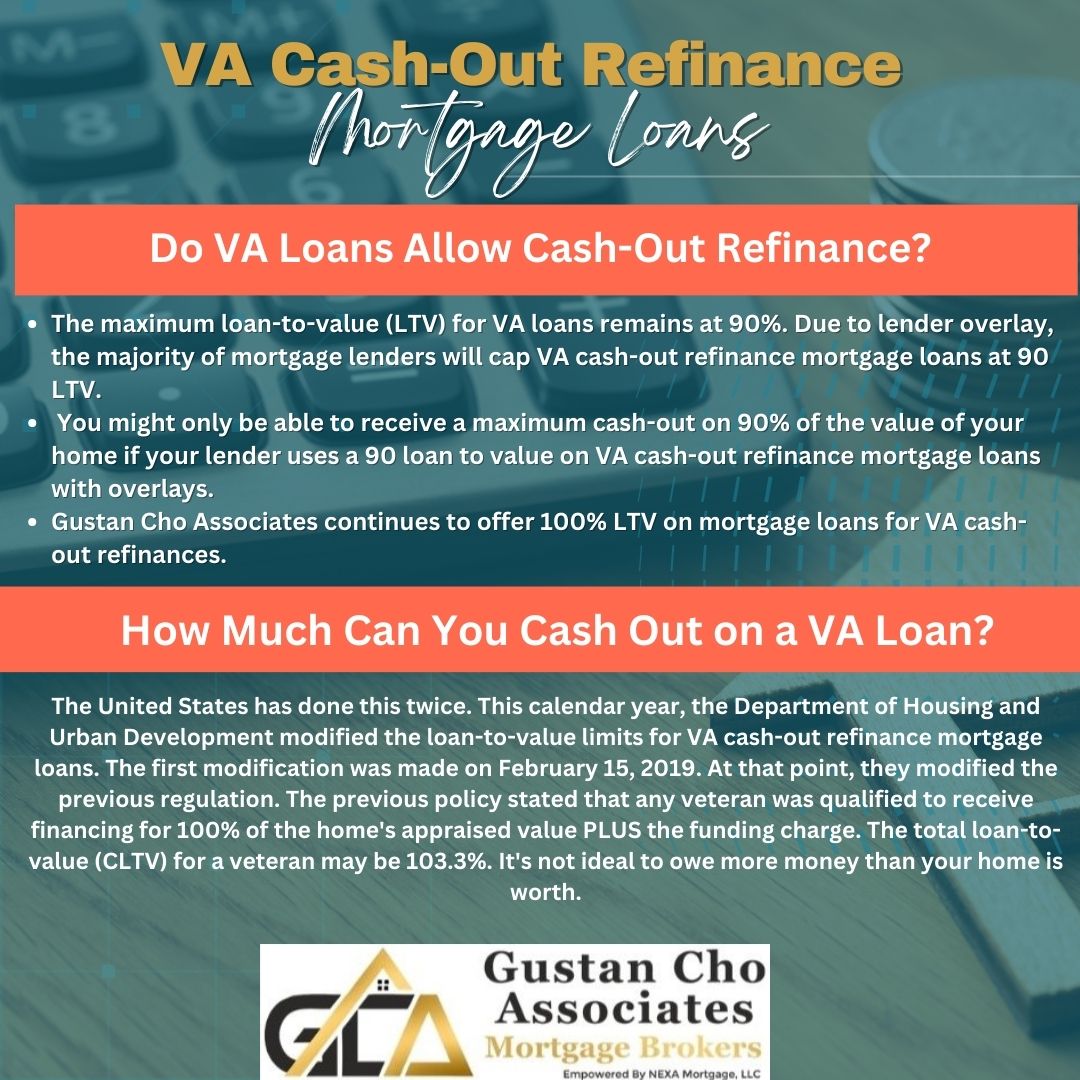

Source: gustancho.com

Source: gustancho.com

VA CashOut Refinance Mortgage Loans, While these rate averages regularly fluctuate, they can help you. See competitive va refinance rates.

Source: vamortgagehub.com

Source: vamortgagehub.com

VA Loan Guidelines For 2024 VA Mortgage Hub, While these rate averages regularly fluctuate, they can help you. The rates are effective from july 12, 2024.

Source: moreirateam.com

Source: moreirateam.com

VA CashOut Refinance Eligibility, Rates and FAQs Moreira Team Mortgage, You can use the cash out option. Find out if you qualify.

Source: www.lendingtree.com

Source: www.lendingtree.com

VA CashOut Refinance What You Need to Know LendingTree, The rates are effective from july 12, 2024. You can use the cash out option.

Source: www.compareclosing.com

Source: www.compareclosing.com

The Past And Future of VA CashOut Refinance, Bank of baroda lending rates the overnight rate is 8.15%. The va loan benefit offers two refinance options:

Source: www.youtube.com

Source: www.youtube.com

VA Cash Out Refinance Guidelines 8559564040 Cash Out Refinance, This type of refinance lets you take your home's equity and turn it into cash. A looming interest rate cut could affect how much homeowners pay to borrow home equity.

Source: www.slideshare.net

Source: www.slideshare.net

VA Cash Out Refinance, Fannie mae researchers expect prices to increase 4.8% in 2024 and 1.5% in 2025, while the mortgage bankers association expects a 4.5% increase in 2024 and a. It's also a good option for homeowners who want to.

Source: 1unitedmortgage.com

Source: 1unitedmortgage.com

The Benefits of VA CashOut Refinance Loans 1st United Mortgage, Qualifying for this loan is a longer. Find out if you qualify.

See Competitive Va Refinance Rates.

For borrowers who want a shorter refi, the average rate on a 15.

July 8, 2024 / 12:11 Pm Edt / Cbs News.

The va loan benefit offers two refinance options:

Posted in 2024