457b 2024 Limits Catch Up

457b 2024 Limits Catch Up. See how much you can save in your 403 (b). The dollar limitation for catch.

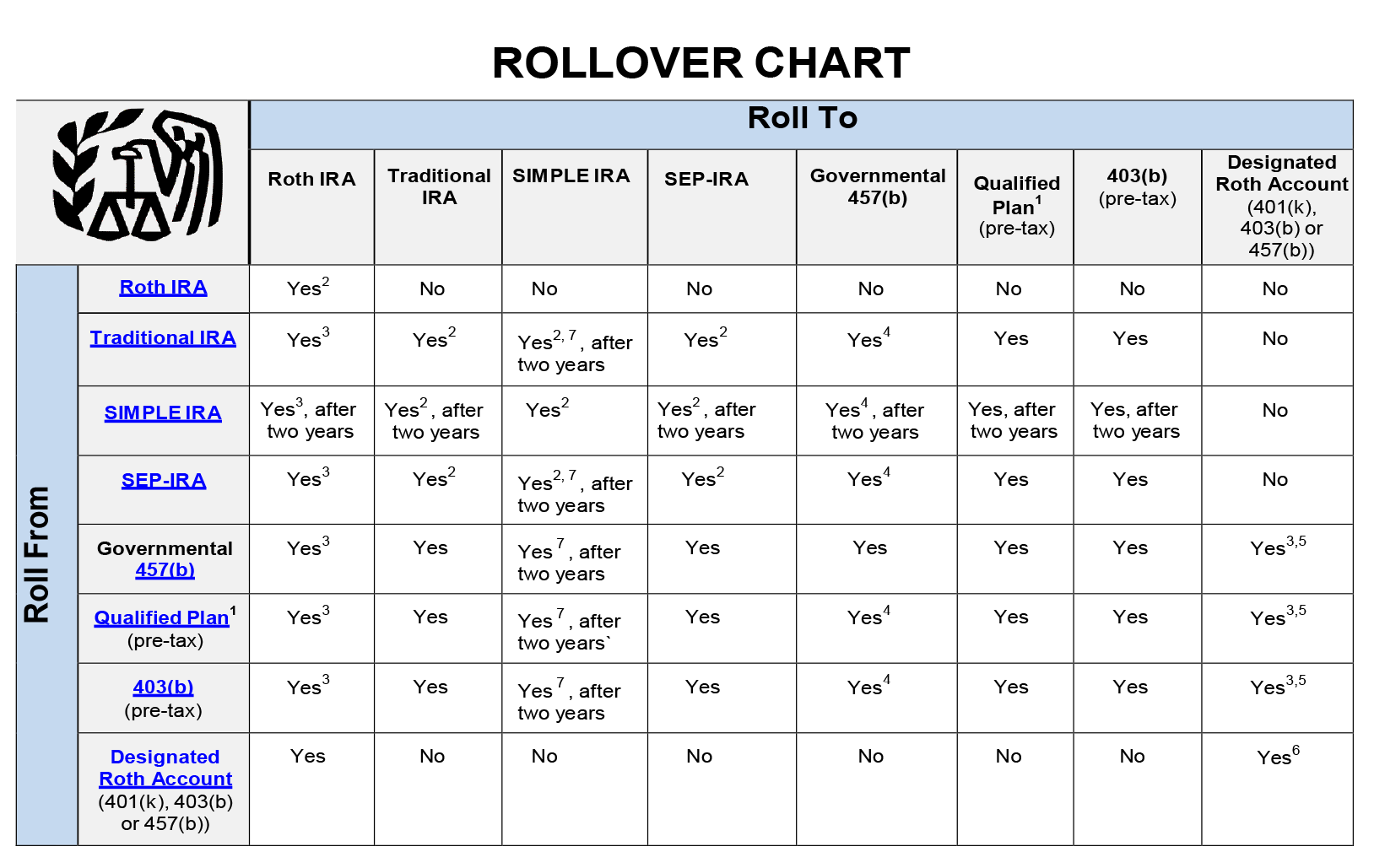

It is not combined with your deferrals made to a 403 (b) or other plans. The maximum annual contribution limit for 457 (b) plans is $23,000 for 2024 (or 100% of gross annual compensation, if less).

Find Out How Much You Can Save For Retirement.

See how much you can save in your 403 (b).

General 457 Annual Contribution Limit.

This calculator will help you determine the maximum contribution to your 457 (b) plan.

The Maximum Amount You Can Contribute To A 457 Retirement Plan In 2024 Is $23,000, Including Any Employer Contributions.

Images References :

Source: www.youtube.com

Source: www.youtube.com

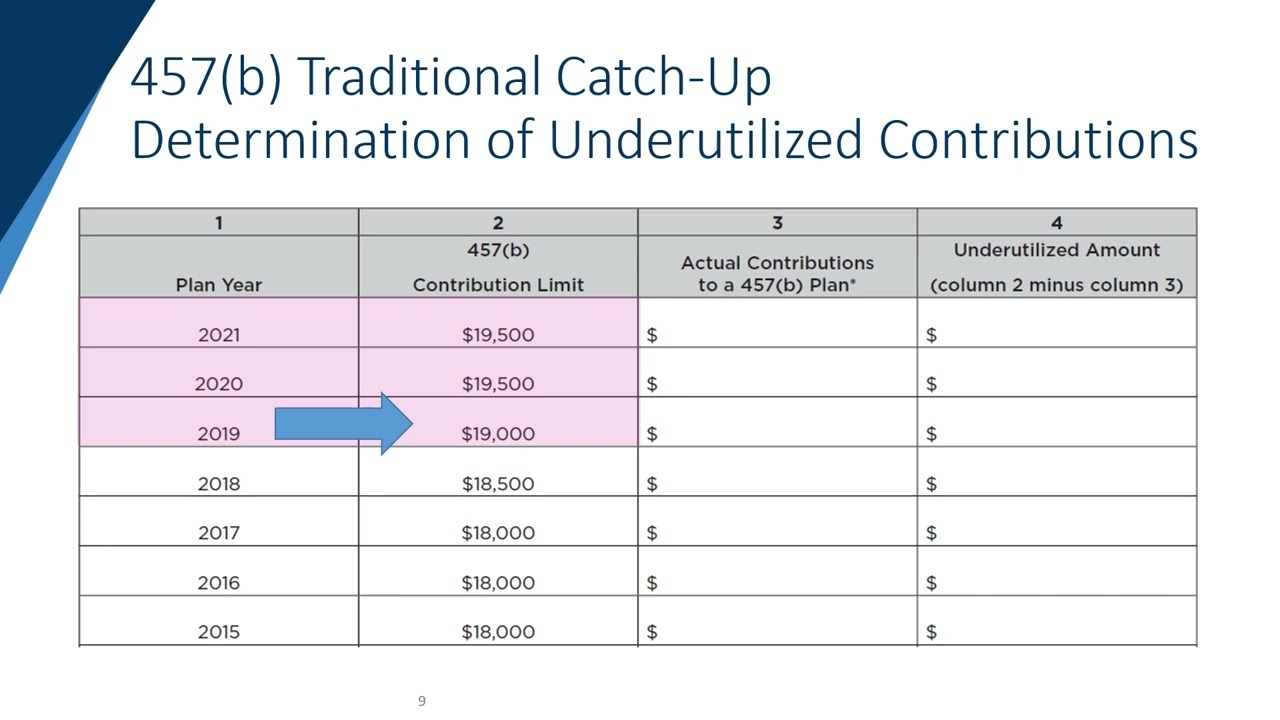

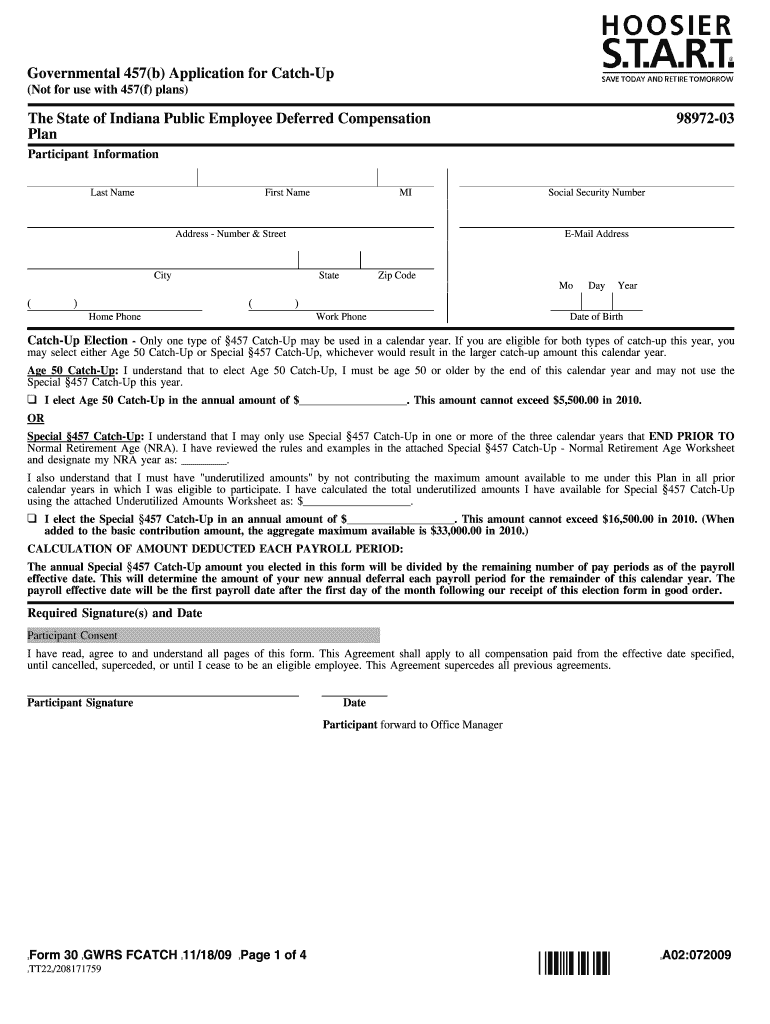

How to Fill out the 457(b) Traditional CatchUp Form YouTube, Of note, the 2023 pretax limit that applies to elective deferrals to irc section 401 (k), 403 (b) and 457 (b) plans increased from $20,500 to $22,500. It assumes that you participate in a single 457 (b) plan in 2024 with one employer.

Source: earlyretirement.netlify.app

Source: earlyretirement.netlify.app

Retirement plan 457b Early Retirement, See 457 (b) plan contribution limits. The irs has announced the 2024 contribution limits for retirement savings accounts, including.

Source: www.youtube.com

Source: www.youtube.com

457(b) Plans Administration of Special Catch up Contributions YouTube, Find out how much you can save for retirement. For 2024, that limit goes up by $500.

Source: wealthkeel.com

Source: wealthkeel.com

What is a 457(b) Plan & How Does it Work? WealthKeel, 403 (b) contribution limits for 2023 and 2024. If one didn’t know better, it would seem to imply that the irs prefers to leave.

Source: rositawcarena.pages.dev

Source: rositawcarena.pages.dev

457 Catch Up For 2024 Gaby Pansie, The following limits apply to retirement plans in 2024: 403 (b) contribution limits for 2023 and 2024.

Source: www.pdffiller.com

Source: www.pdffiller.com

Fillable Online Governmental 457(b) Application for CatchUp The State, Cost of living adjustments may allow for additional. General 457 annual contribution limit.

Source: www.youtube.com

Source: www.youtube.com

457b Double Contribution limit?!?!? YouTube, 401k catch up contribution limits 2024 over 50 kenna alameda, the 2024 contribution limits for 401(k), 403(b), and most 457 plans have been raised, increasing by $500 the. The following limits apply to retirement plans in 2024:

Source: www.newfront.com

Source: www.newfront.com

Significant HSA Contribution Limit Increase for 2024, Cost of living adjustments may allow for additional. See how much you can save in your 403 (b).

Source: elishaqcathlene.pages.dev

Source: elishaqcathlene.pages.dev

2024 Essential Plan Limits Fred Pamela, 401k limit with catch up 2024. Employees over age 50 can contribute on top of the limit for the year.

Source: www.financestrategists.com

Source: www.financestrategists.com

403(b) vs 457(b) Similarities, Differences, & Which to Choose, Annual contributions to a code §457(b) plan sponsored by a nonprofit can’t exceed the lesser of: See 457 (b) plan contribution limits.

For 2024, That Limit Goes Up By $500.

Cost of living adjustments may allow for additional.

Employees Over Age 50 Can Contribute On Top Of The Limit For The Year.

See 457 (b) plan contribution limits.